The new HMRC Construction Industry Scheme (CIS) that came into effect on 1st March 2021, means that VAT has to be accounted for differently for CIS registered customers depending on the circumstances. So for one customer for one hire you won’t charge them VAT, yet on another to the same customer, you will charge them VAT. This gets even more confusing when supplying staff with a hire, as the staff element may or may not be subject to normal VAT.

The new HMRC Construction Industry Scheme (CIS) that came into effect on 1st March 2021, means that VAT has to be accounted for differently for CIS registered customers depending on the circumstances. So for one customer for one hire you won’t charge them VAT, yet on another to the same customer, you will charge them VAT. This gets even more confusing when supplying staff with a hire, as the staff element may or may not be subject to normal VAT.

HireHop equipment rental software makes this complex problem easy to overcome and simple to implement, especially for your part time staff at your front desk who probably don’t fully understand CIS.

What is Construction Industry Scheme VAT reverse Charge?

The reason for CIS is that it moves the VAT liability from the supplier of a service in the construction industry to the customer as an anti-fraud measure, preventing suppliers from receiving huge VAT amounts and not paying them to the HMRC.

If you do not supply the construction industry, or fall into one or more of the following categories, you don’t need to worry and can stop reading this:

- You are already VAT exempt for the building and construction services.

- Supply products or services that are not covered by the CIS, unless they are directly linked to such a supply.

- You only supply staff or workers.

What Customers are Subject to the Reverse Charge?

The CIS reverse VAT charge does not apply to VATable supplies made to the following customers:

- The customer is not VAT registered.

- The customer is not CIS registered.

- ‘End Users’, being a customer who is not supplying their service to another client.

- ‘Intermediary suppliers’ who are connected, like if the customer is also the end user like a landlord, and both are owned by the same group/person.

- Overseas customers outside of the UK.

How DRC impacts your plant and tool hire business?

If you are a VAT-registered hire company that provides services to a building and construction services VAT-registered company/person (your customer) who is CIS-registered, then you no longer need to charge them VAT. Instead, your invoice should inform your customer that the VAT reverse charge is applied as they are responsible for the VAT using the reverse charge procedure.

If you use accounting software like Xero, Quickbooks, Sage, etc, then it should already have a CIS domestic reverse charge (DRC) VAT rate that equates to 0% that you would use, if not then you need to set it up or contact them on how to do this.

Examples

All of the following examples assume that you are a VAT registered company/person, supplying to the same VAT registered company/person:

- Your hire company supplies an excavator to a building company that is CIS registered. The building company is not the end client. In this scenario you do not charge the customer VAT due to CIS.

- Your hire company supplies an excavator to a building company that is not CIS registered. Regardless who the end client is, everything you supply is subject to normal VAT as your customer is not CIS registered.

- Your hire company supplies an excavator to a building company that is CIS registered. The building company is using it to clean up their own yard, thus they are the end client. In this scenario everything you supply is subject to normal VAT.

- Your hire company supplies an excavator with an operator for an all inclusive price to a building company that is CIS registered. The building company is not the end client. In this scenario VAT is not charged for both the excavator and operator due to CIS.

- Your hire company supplies an excavator at a price and an operator at seperate price to a building company that is CIS registered. The building company is not the end client. In this scenario VAT is not charged for the excavator due to CIS, however, however the operator is still subject to normal VAT as it is a seperate staff charge.

How Does HireHop Equipment Rental Software Make This Easy

There are a number of ways HireHop can manage CIS reverse charges, however we will explain here the simplest method to use.

- Create a virtual depot in each depot which is where CIS jobs will be assigned to.

- Make sure that the Domestic Reverse Charge VAT rate has been imported from your accounting software, or add it into HireHop manually if you don’t synchronise HireHop with accounting software.

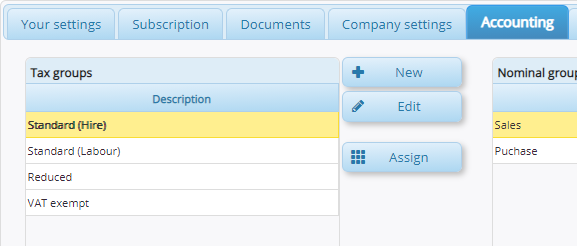

- Setup your VAT/Tax Groups to include two standard rates, one for hire items and one for labour and staff, maybe similar to below:

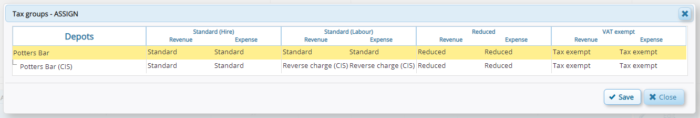

- Assign the various VAT/Tax Groups to the required rates in each depot, similar to below (you can see the virtual depot for CIS applicable hire jobs):

- When creating a job, if it is a CIS job, just assign it to the CIS virtual depot. This means that every invoice issued, whether done manually or via batch invoicing, the correct VAT rates and charges will be applied without any more user intervention needed.

If you need any help implementing this, please contact HireHop.